The halvening is here! For the uninitiated, this will serve as a short explainer.

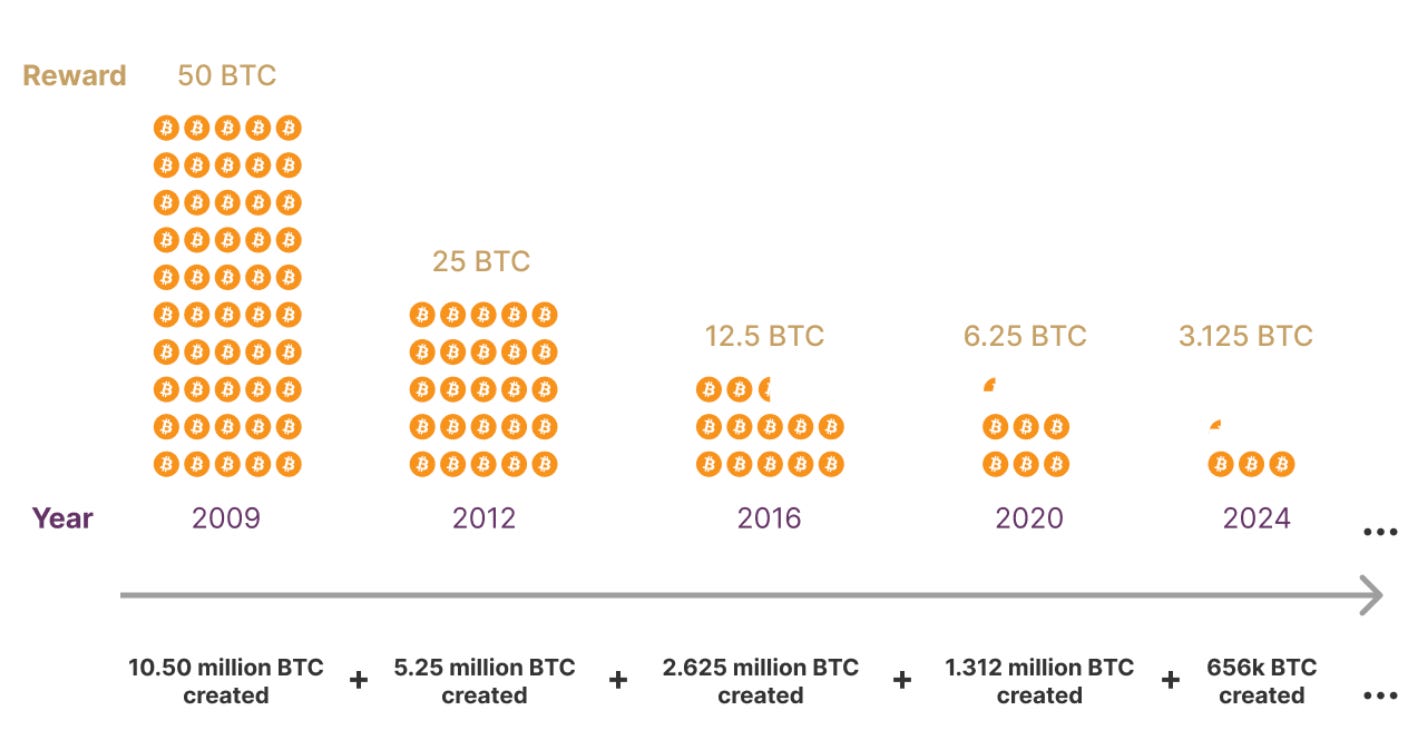

Bitcoin’s total supply of 21,000,000 will be mined at a disinflationary rate, with the rate of inflation being cut in half every four years. The first 10.5m BTC were mined in the first halvening epoch from 2009, and the final satoshi will be mined in ~2140.

History of halvenings:

January 3rd, 2009: the genesis block is mined with a block subsidy of 50 BTC

November 28th, 2012: the first halvening cuts the block subsidy from 50 to 25

July 9th, 2016: the second halvening cuts the block subsidy from 25 to 12.5

May 11th, 2020: the third halvening cuts the block subsidy from 12.5 to 6.125

April 19th, 2024: this evening (or perhaps early tomorrow morning), the fourth halvening will cut the block subsidy to 3.125

Halvenings are typically seen as catalysts for price appreciation, because the number of BTC that can be sold onto the market by miners is reduced. Four years ago, at the last halvening, the BTC price sat at roughly ~$10k. At the time, 1.8k new coins were being mined per day, which amounted to an additional $18m of potential selling pressure. After the halvening only 900 coins were produced per day, and the price adjusted to meet the cut in the supply (in that instance, rising from $10k to $65k in the following 11 months). The story has been exactly the same after every Bitcoin halvening, albeit with diminishing returns each epoch.

With the previous ATH at $69k (I believe the price even wicked to $69,420 on some exchanges, but I’m not sure), many were hoping that a run of “lucky” (meme) numbers may continue. However, rather than happening tomorrow, on 4/20, the Bitcoin halvening will happen this evening. Estimating the exact time of the halvening isn’t easy, because it largely depends on the rate at which blocks are being mined. A halvening occurs every 210,000 blocks, which are intended to be 10 minutes each. However, as hash rate rises block times can fall below the 10 minute average (every two weeks, or 2016 blocks, a difficulty adjustment occurs, requiring either greater or reduced hash rate to bring the average block time for the next epoch back to 10 minutes).

The dynamic today is completely different from the previous halvening, and its worth considering some of the things that changed in the epoch that is now drawing to its close (2020-2024):

Microstrategy released the playbook for corporate adoption of Bitcoin

Two nations (ES and CAR) made BTC legal tender, and circular economies begin to thrive using the LN

Insane fiat printing and monetary debasement

US BTC ETFs approved

FASB rules approved to make BTC accounting for companies easy (to be implemented later this year)

First Bitcoin politicians in the US — Bitcoin wasn’t even a discussion at the 2020 US presidential debates

A fairly brutal bear market courtesy of China FUD, Elon’s tweeting, and leverage

Hong Kong ETFs approved

A clearing out of incompetent and malevolent figures: 3AC, FTX, Celsius, Terra, Voyager, Babel, Grayscale, BlockFi, Gareth Solloway…

Numerous DeFi failures and innovations

Humanitarian crises in Afghanistan, Ukraine, Palestine, Ethiopia, Sudan, Myanmar, Syria, Yemen, Armenia, Azerbaijan, the DRC, Nigeria and Somalia

An insane rise in authoritarianism and state-mandated gaslighting as countries around the world lock up their citizens over a coronavirus and coerce them into taking experimental medicines to appease big pharma

Peter Schiff’s son became a Bitcoin maxi for a few weeks before selling everything as soon as the price started going down

Of course, this is by no means an exhaustive list, but its within this context of development that cutting the newly-mined supply of BTC from 900 to 450 per day removes $31.5m of potential selling pressure per day (assuming a BTC price of $70k).

Significance of this halvening

“You should spend as much time stacking sats as you spend stacking conviction”

— American Hodl at the Cheat Code conference in Bedford

Each halvening has been significant in its own way, with Bitcoin’s inflation rate being cut in half in each time. Another way of expressing the inflation rate of an asset is the stock to flow (S2F). This is arguably a far more appropriate way to measure an asset’s dilution over time, since there’s no risk of conflating dilution with second order effects (hence the ambiguity between monetary inflation and price inflation, largely proffered by Keynesian maxis). Bitcoin’s inflation rate today currently stands at just 1.7%, which gives it a stock to flow of ~59. This means that it would take 59 years for the newly-mined Bitcoin to come to equal the preexisting supply. As the newly-mined supply of Bitcoin is cut, S2F increases.

According to a report by In Gold We Trust, gold has had an average stock to flow of 66 from 1990 to 2010. Silver’s S2F has consistently been higher than this throughout history because silver is easier to find, which means that its value can be diluted more easily over time — the reason silver doesn’t hold its value as well as gold is because its easier to mine more silver relative to the existing supply than it is for gold. The absolute quantity of an asset is irrelevant; the only thing that matters for storing value is that it is difficult to dilute.

In just a few hours, Bitcoin’s S2F will rise above gold, making it the scarcest asset in the world. Interestingly, S2F modelling doesn’t have to be applied solely to commodities: it is estimated that the property market has a stock to flow of circa ~100 (which Bitcoin will also surpass in a few hours). To a great degree, the scarcity in housing in recent generations explains why property has been preferable to gold as a store of value. The stock to flow also explains why future generations will consider real estate inferior to Bitcoin. This phenomena will be particularly prevalent as artificial intelligence and robotics breakthroughs coalesce to reduce the cost of construction to almost nothing.

What makes Bitcoin unique as an asset is that its supply is completely inelastic. For every other asset in the world, there is an incentive to increase supply if price increases. For example, if the price of gold increases, gold miners will procure more of it (lowering the S2F), which is sold onto the market and suppresses price. If a stock increases dramatically in value, the CEO will come to realise that he can easily raise capital by issuing more stock and diluting preexisting shareholders. If the value of property rises, more properties can be built. By contrast, it doesn’t matter if the price of BTC rises 10%, 100%, 1,000%, or 10,000%: the S2F will be completely unaffected.

The cherry on the cake is that Bitcoin’s inflation rate is on a terminal velocity of 0% (it will even become deflationary as coins are lost), and its S2F will go infinite. In such a way, Bitcoin can become the asset that monopolises demand for a store of value, allowing monetary premia in all other asset classes (after all, Bitcoin’s price is 100% monetary premium; there isn’t a percentage of the Bitcoin network that is used for heavy industry, jewellery, etc.) to drop to zero and reach fairer valuations based on their consumption/utility value.

Historically, the halvening has been credited for creating some beautiful chart patterns. All price charts really do is showcase how human emotion responds to economic realities (and perceptions thereof) in real time. In the model below, anonymous on-chain analyst known as Plan B shows how one could try to forecast price by cubing the S2F. Remember: all models are wrong, but some are useful. Plan B’s models have been both applauded and scorned, but to my mind remain reasonably accurate. More importantly, they very clearly showcase the phenomenon of how price responds to rising scarcity.