Over the past few days the entire cryptocurrency market has taken a tumble, and for newcomers the volatility is something that can be somewhat unnerving. There are a few reasons for this, but the most significant by far has been the collapse of Terra’s UST stablecoin. This one event wrought havoc, and also created chaos in other markets via a series of cascading liquidations and forced sell pressure. This article is a post mortem for the Terra project, which appears (despite the somewhat humbled Tweets of Do Kwon) to have now completely died.

What is Terra?

Terra is a company focused on building algorithmic stablecoins. Unlike stablecoins such as Tether’s USDT or Circle’s USDC, the mechanics for the way in which the UST holds its peg to $1 is not based on the stablecoin itself being backed by an equivalent amount of dollars. This means that the extent to which the algorithm maintains its peg at $1 largely depends on the arbitrage incentives and whether or not faith in Terra’s ability to keep UST at the peg price persists.

Terra was launched in 2019, and for much of that year and 2020 there was little progress in terms of market cap expansion. In 2021, that all changed, and LUNA went on to have an incredible bull run: the year started with the price at $0.65 and in April 2022 LUNA hit an ATH of $120. In the same period, UST’s market cap rose from approximately $200m to a high of almost $20 billion, making it one of the largest and most widely-used stablecoins in existence. This was largely helped by the fact that holders could earn 20% interest on their UST - in an era of negative real yields on fiat, such an interest rate was extraordinarily enticing for many, and worth the risks of a de-peg.

As one of the largest stablecoins in existence, Terra’s community had developed quite a following, including some of the most prominent characters in the cryptocurrency arena. Mike Novogratz, for example, recently posted a picture to Twitter a tattoo that he had drawn on his arm. Such exuberance wasn’t particularly uncommon in the Luna community, particularly since many of them had been so emboldened Terra’s growth. In the same way that Chainlink have their “Link Marines” and Ripple had their “XRP Army”, the Luna community liked to affectionately refer to themselves as “LUNAtics”.

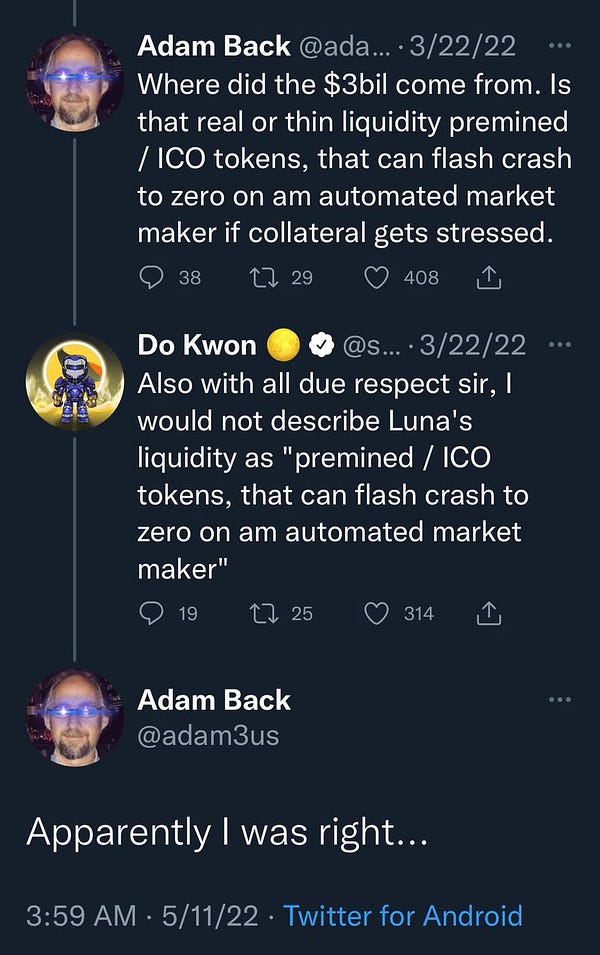

The founder of Terra, Do Kwon, has never been one to shy away from confidently espousing his views that Luna is a key to wealth and that the algorithm is safe and secure. On many occasions, he has been known to lambast and insult people who have sold their LUNA or UST, repeating that they ought to “have fun staying poor”. Whilst LUNA was experiencing exponential growth this form of rhetoric, although unnecessary, helped to galvanise the LUNAtic community behind him and to cement support; however, it appears that Do Kwon’s attempts at reassurance only had ephemeral impact.

The Bitcoin Acquisition

In February, Do Kwon announced that Terra would be acquiring Bitcoin in order to supplement the “backing” of UST, with the goal of recreating a financial system in which stablecoins can be used for transactions whilst always maintaining a firm Bitcoin backing. It is fair to say that the reaction to this announcement was mixed, at best. Opinions ranged from Bitcoin maximalists proclaiming that Luna was a scam and the whole project would soon unravel (it turns out they were right) to a wave of interest in the project as people theorised about the benefits of recreating a financial ecosystem in which stablecoins can be fully backed by Bitcoin. Those who were more familiar with Luna’s mechanics were sceptical of the decision: even though from a marketing sense it may look strong to acquire $10 billion of Bitcoin and become the single largest holder, doing so rather than maintaining the current mechanics exposes a lack of faith and trust that the current mechanics would continue to function as promised; changing strategy to back UST with BTC rather than relying on the preexisting mechanisms triggered a wave of uncertainty and caused a lot of people to lose faith in the project.

The Loss of Peg

Since UST largely relied on confidence in order to maintain its peg to $1, once confidence was lost it was game over. In theory, 1 UST should always be redeemable for $1 worth of LUNA, meaning that if UST went above $1, it would be sold back to the peg, and if it went below $1, it could be redeemed for $1 of LUNA. This meant that when UST drifted too far from the peg, LUNA suffered from a lot of selling pressure and confidence in UST was so lacklustre (partly due to a lack of transparency of behalf of the Luna Foundation Guard) that the mechanism instead worked to bring LUNA and UST into a death spiral.

There has been some speculation as to why the peg was lost at this particular moment, and if it is possible that there was some foul play. According to the grapevine, this is exactly what happened: although no conclusive evidence has been offered, Blackrock and Citadel have been accused of causing the crash. Although this has been categorically denied by every party involved, it is speculated Blackrock and Citadel took out a loan of 100,000 Bitcoin from Gemini, went to Do Kwon and asked made him an offer to buy some of the BTC at a reduced price in exchange for UST. The latter then accepted, but it meant that UST reserves had shrunk and there was thus less liquidity. This was combined with the 4pool FRAX announcement for UST on April 1st, which also meant that there would be less liquidity for UST.The former then dumped the Bitcoin on the market, crashing the price and forcing UST to lose its peg. On Chain Wizard wrote more about this here:

If this story is true, it is quite probable that the culprits also shorted LUNA. Do Kwon tried to allay fears on May 9th by announcing on Twitter that the LFG had voted to provide $1.5 billion in liquidity, hoping to ease fears of losing the peg and to reassure the community. This did not work, and Luna was forced to sell all of the Bitcoin that they had acquired (over $3 billion) in an extremely short space of time, which compounded problems for the rest of the market.

Conclusion

This afternoon, Terraform Labs announced that the price of LUNA had fallen too low to prevent governance attacks, and as such the validators have decided to shut down the chain and to bring it to a halt. My personal view on this is that this is quite a pointless exercise, given that the project has already died and there really isn’t anything to salvage: the mechanics of the algorithmic stablecoin have ostensibly been shown not to be strong enough to survive.

Whilst this is the largest single stablecoin collapse that there has ever been in cryptocurrency history, and whilst it is the fastest and one of the most brutal downfalls of any project I have ever seen, one should always keep in mind that such volatility isn’t to be wholly unexpected, and that there are there risks (some of which are unknown) associated with cryptocurrencies on a technical level, but there are also incentives for “bad actors” to make decisions that damage the masses. This is particularly true of centralised projects like Terra, in which a lack of transparency combined with questionable algorithms and unprofessional leadership caused the entire project to implode within a matter of hours.

To end this saga, Terraform Labs decided to shut down their blockchain, and the validators brought the chain to a halt. The reason that they give for this was that the dilution in Luna meant that governance attacks were now more likely. This is a sad way for the blockchain to end — and it is the end for Luna — since all it proves is that the project was a load of centralised nonsense all along.

Retail suffered the most from this collapse. Around the globe there were millions of holders of Luna, and the cult-like following that Do Kwon had managed to engineer had gained a lot of trust for the project. Yesterday, Twitter (and particularly the Terra Luna Reddit) was resplendent with cryptocurrency communities posting suicide hotlines and sharing stories of how they’d lost all the money they had in the world.

Regulators are looking to this and will undoubtedly use this as an example for what happens when free markets are not well regulated. There is no doubt about it: this is a blot on the entire industry. Over the coming weeks I would not be surprised if the markets are full of stories about how DAO treasuries have been drained, company balance sheets are now worth next to nothing, and, of course, we will continue to hear more stories about individuals losing everything.

So is more regulation needed? There is certainly an argument to made for this, and undoubtedly the SEC will come to legislate that cryptocurrencies such as LUNA constitute unregulated securities. However, it is my contention that this collapse, whilst painful for many in the short term, may have been a necessary evil. This collapse demonstrated that Luna’s fundamentals simply weren’t strong enough to be sustainable, and that if they had grown even larger before the opportunist economic hitmen decided to destroy the entire ecosystem, the effects would have been even more devastating.

More importantly, this has been a force for cultural reckoning in the blockchain space. It has cut out a lot of the froth and unjustifiably inveterate optimism. Naivety has been punished and people are forced to learn more about the quality of assets and differences between unregistered securities and digital property (Bitcoin). The importance of diversification, not only in terms of assets, but in terms of how one safeguards their assets, is an important lesson that the cryptocurrency community must if we are to reap all the benefits associated with being a sovereign individual and decentralising power structures.

Really a sad story. We all need to take stock in how this happened.