Every new cycle in the crypto markets there are players, new projects, and new downfalls. 2022, thus far, has already been the most extraordinary - no other year has provided quite the same degree of outrage and chaos. Celsius, 3AC, LUNA, Voyager, Babel, BlockFi, and now FTX have all imploded spectacularly over the course of the past year. FTX’s meltdown over the course of the last week has truly been something to behold, with a story that isn’t just outrageously illegal, but also shocking and extraordinary, with as many twists and turns as one could hope for from an Agatha Christie novel…

Almost every major player over the course of 2022 has been somehow involved in the events have been unfolding over the past few days, with Do Kwon and Martin Shkreli making an impromptu appearance on the UpOnly podcast to speculate on the likelihood of SBF going to prison, as well as reflecting on their own crimes.

The FTX meltdown

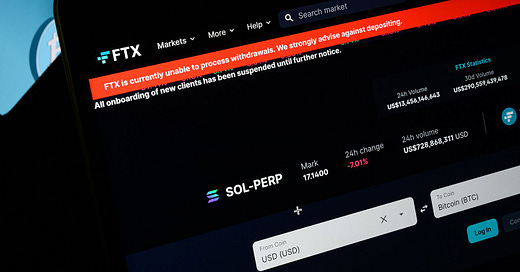

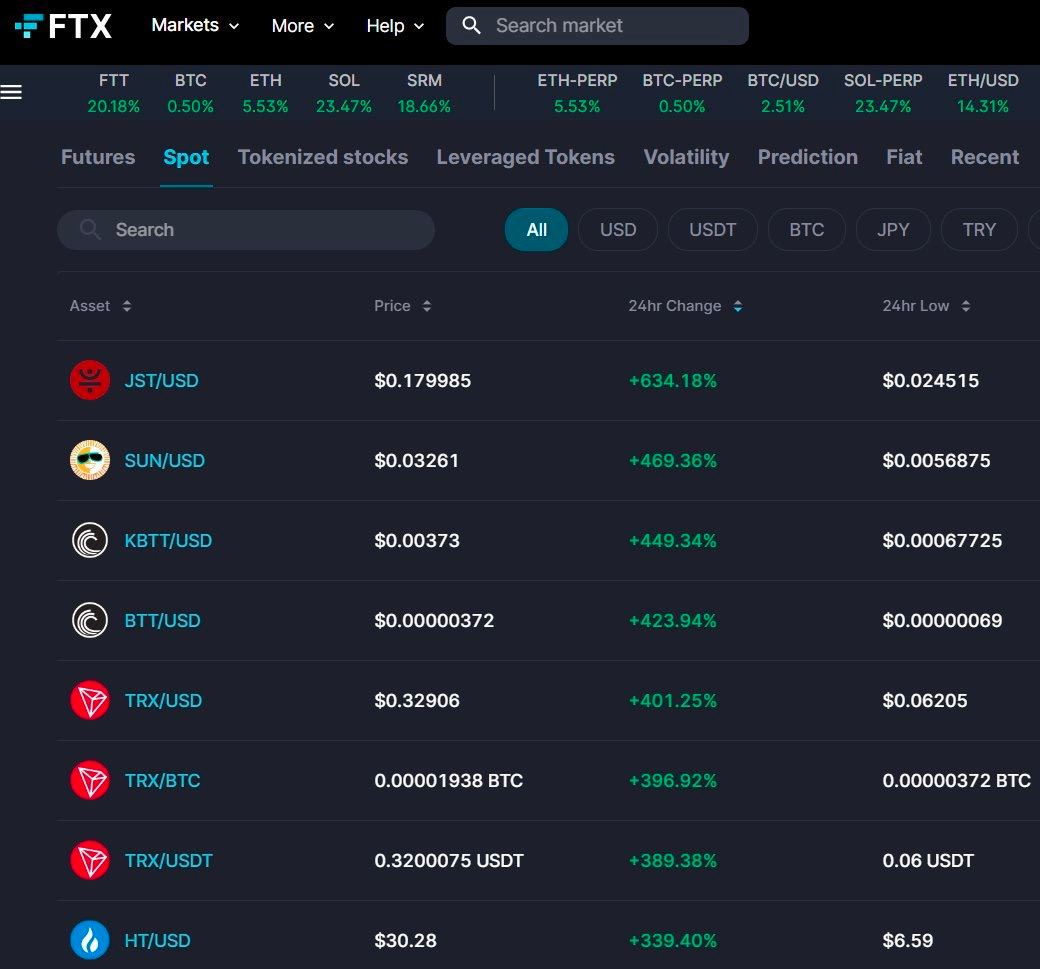

Over the course of the last few days, the crypto markets have once more been mired in disbelief at the level of lies and deceit that CEOs are willing to enact in order to keep their empires afloat.

In Q2, there was a string of crypto companies going bankrupt. It seemed as though there was a different company going bankrupt every single day after the collapse of LUNA, to which many industry participants had great exposure. During this time, many large names went bankrupt and the Bitcoin price subsequently collapse in value as alt coin prices were destroyed.

However, there were two industry giants of note that not only seemed strong throughout this, but appeared completely dominant. Binance and FTX, seemingly remaining extremely well-capitalised, went on a buying spree of bailing out and acquiring a series of companies that had fallen on hard times. SBF’s acquisition spree seemed particularly aggressive, as he acquired large names such as BlockFi (to the delight of their unsecured creditors).

News that emerged last week triggered a wave of scepticism over exactly how solvent FTX and Alameda (a hedge fund that operated as a sister company to FTX, also owned by SBF) actually were. An article published by CoinDesk revealed a leaked version of Alameda’s balance sheet, which was concerning to say the least.

The balance sheet revealed that of the $14.6 billion in assets that Alameda had on their balance sheet o June 30th, approximately $6 billion was FTT, which was being used as collateral.

When an exchange prints its own token, for whatever reason, they are able to give themselves a disproportionate amount of the supply. The issue in the case of FTX and Alameda was that a significant amount of these tokens were being put up as collateral to take out more loans. More specifically, FTX was loaning FTT to Alameda, who used it to borrow stablecoins. This meant that when the price of FTT fell, the company ended up a with a massive gap in their books.

CZ felt that something was awry, and declared that Binance was to be selling their $580m of FTT. For some context, Binance was an early investor in FTX, and had sold their equity last year in the project for $2.1 billion in a mix of BUSD and FTT. This news was met with shock by the team at Alameda, who realised that this would liquidate them. The CEO of Alameda, SBF’s girlfriend Caroline, decided to tweet that the balance sheet leaked was only a part of their balance sheet and that they actually had far more assets — very few people believed this.

She then offered by buy all of CZ’s FTT from them at $22, an offer which sparked chaos in the markets as investors realised that such an offer would only be made if Alameda and FTX were in real trouble, and the price soon broke the $22 support, and then went much further.

Seeing all of this controversy, SBF reached out to Binance asking to be acquired. He realised that he had few options left, and Binance entered into an agreement to buy FTX, but reserved the right to withdraw after examining their books. Binance announced very shortly after that they were withdrawing from the deal, and then since then the entire company has collapsed into pandemonium. Some were crediting with CZ with playing 5D chess, but he has reiterated several times that he would not do this, did not know the extent of FTX and Alameda’s losses, and was sincerely trying to help the industry. After all, when a player as large as FTX fails, it is a catastrophe for the rest of the industry as well. Unfortunately, he could not go through with the deal once he had realised just how bad things were.

Astonishing hypocrisy

There are many ways in which SBF’s insincerity has been laid bare by the events of the past week. Firstly, his campaign over the course of the last few years has been one in which he has consistently tried to brand himself as “one of the most generous people in the world” who “only wants to get rich to support charities”. His ideas of “effective altruism”. This has come back to bite him, given that millions of users have now collectively lost tens of billions of dollars thanks to his antics.

One of the most obscene aspects of this story is the fact that only weeks earlier, SBF was actively campaigning for more regulation in the crypto space. Specifically, he wanted there to be more oversight in DeFi (not in CeFi), and for DeFi front ends to be forced to use KYC. In a debate with Erik Vorhees, who was campaigning for greater freedom in DeFi and for permissionless protocols to remain permissionless, SBF was campaigning for more regulation.

The hypocrisy of demanding more regulation (and SBF was actually helping to draft bills going through Congress that would dictate this regulation) is astonishing. What makes it more astonishing is how blatantly self-interested these regulations were: regulating DeFi wouldn’t have harmed SBF in any meaningful way. In fact, it may even have forced more retail users who aren’t familiar with spinning up their own infrastructure onto custodial exchanges, and would have made criminals of those who would have interacted with such DeFi. Moreover, it wouldn’t have actually stopped any criminals with interacting with DeFi, given that one can still interact with smart contracts without a front end if they are tech-savvy enough — the only thing that would have happened if SBF’s ideas had come to fruition is that retail speculators would have suffered even further.

FTX employees completely rekt

It isn’t only customers of FTX that suffered from the downfall of the empire, but also FTX employees. Many employees were actively encouraged by SBF to deposit to the platform in exchange for high rates of yield on their savings and stock options.

The overwhelming majority of FTX employees had no idea what was happening at the upper echelons of the exchange, and in many cases have lost everything.

Drug-fuelled orgies in the Bahamas

In October, speculations were rife that the newly-acclaimed Sushiswap CEO had molested a horse, and this truly seemed like a new degree of moral depravity for the crypto space. Fortunately, it transpired that these allegations were false, and that he was actually mistaken for a pornstar of the same name who allegedly did molest a horse a few years ago.

Nevertheless, the level of moral depravity in the crypto world has continued to be astounding, with the news that 10 of the major executives at FTX all lived together in a penthouse, within which they shared polyamorous relationships and amphetamine-fuelled orgies.

A far cry from the now-laughable “effective altruism” as promised by both SBF and his girlfriend Caroline, which appeared to have been little more than a marketing ploy for their empire of deceit.

Population of the Bahamas goes parabolic

Even after the entire empire had completely imploded, SBF still managed to find ways to unite with nefarious parties to continue to embark on legally-questionable practices.

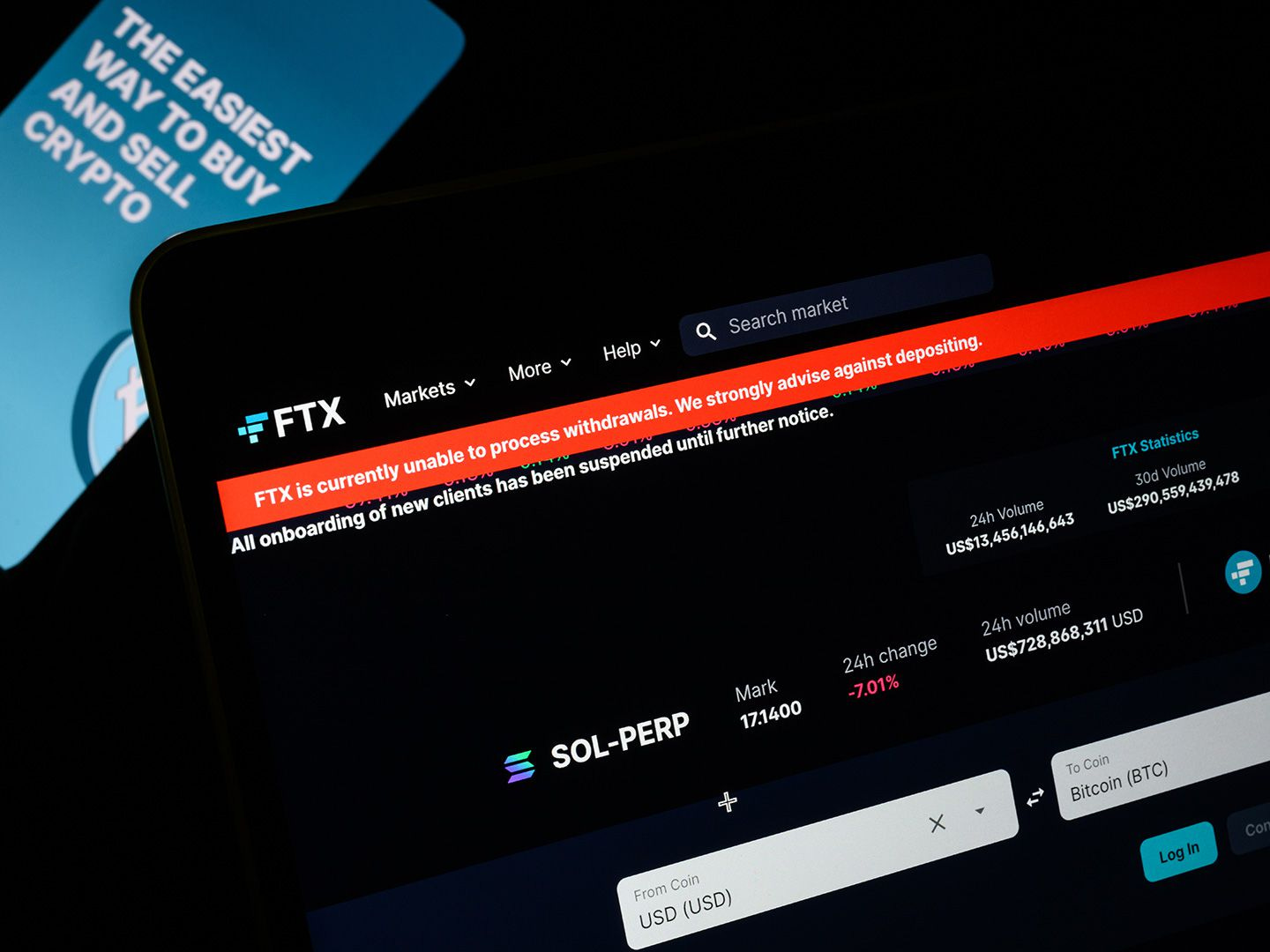

After withdrawals were halted on FTX, Justin Sun (who hasn’t always been known as the most honourable character) managed to broker a deal with FTX in which holders of assets of his projects would be bailed out - all holders of coins and tokens that Justin Sun managed would be able to withdraw and to be exchange their holdings 1:1 in a unique deal.

This has been extremely controversial. Over the next few hours after the announcement, the values of TRX, HT, SUN, and JST ballooned on the FTX exchange. The deal provided an opportunity for Sun to save some of the people who had invested in his projects, and the opportunity for those still trading on FTX to acquire his assets at a massive premium to NAV, taking a huge haircut when withdrawing their funds.

The other way that people were able to get their funds off the exchange is if they lived in the Bahamas, where the exchange is based. Very quickly after this, many people tried to either KYC themselves in the Bahamas, or pay people who had KYC in the Bahamas for the right to withdraw their funds via them.

Deals were brokered and many Bahamanians have become extremely wealthy overnight for the cuts that they have taken. One of the main ways that this was facilitated was by residents of the Bahamas minting NFTs on the FTX platform, selling them for the entirety of someone’s user deposits, withdrawing their assets, taking a cut, and then sending the funds back to the rightful owner. This issue became so problematic that FTX has now completely frozen their NFT offerings as well — an absolute shit show if there ever was one.

A huge taint on the industry

Clearly, there are many reasons why this disaster has been a taint for the industry, not least of which the fact that SBF was one of the largest donors to the Democrat Party, second only to George Soros.

It would be no surprise to discover that this fiasco has set the industry back several years. US regulators, who until this point haven’t been that friendly to DeFi anyway, are certain to now come into the space with far stricter regulation than they would have done before this instance.

However, there are some silver linings to the volatility of the past week. Despite the fact that almost every major CeFi company is now being heavily scrutinised, many are now completely bankrupt, and faith in third parties has been further eroded once more, DeFi has continued to operate seamlessly. Protocols such as Aave, Maker, Uniswap, Compound, and others, have continued to do exactly as they say on the tin. The fact that everything that happens in DeFi protocols is completely transparent is a huge boon for the financial industry, and a huge improvement on the current state of affairs.

It remains to be seen if regulators will come to distinguish between the state of affairs at large crypto companies like FTX and Celsius, and the immutable code enshrined in Uniswap v2. There is a huge difference between the two, but such large meltdowns are liable to cause politicians to act with hysteria, which could have been avoided.

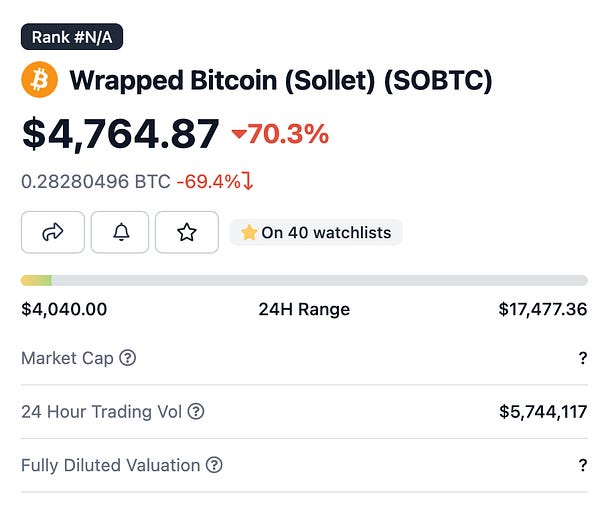

Centralised projects masquerading under the guise of “DeFi”, such as Solana, have also suffered from the collapse of FTX. Wrapped assets on the Solana blockchain have completely lost their peg, and thanks to the collapse of FTX there is no way that these can be redeemed. The process of wrapping tokens always comes with some degree of counter party risk, as blockchains fundamentally struggle to communicate with one another so require centralised custodians.

The fact that Solana also pretends to be DeFi, in the same way that Polygon pretends to be DeFi (“please don’t look at our multi sig wallet!”), is yet another vector by which the more decentralised aspects of the industry are going to suffer with undeserved damage to their reputations as a result of this collapse.

For those who want the greatest assurance that their assets cannot be tampered with, there is no better asset than Bitcoin (although this only counts if you take custody of it yourself).

Another round of contagion…

After the collapses of Three Arrows Capital, the Celsius Network, Terra, and many others earlier this year, there was a round of contagion that spilled over into other companies. Those who had loans to particular companies, or held funds on their platforms, were suddenly put under a lot of pressure as they went underwater.

It appears that this time is no different, and FTX’s dramatic collapse has already triggered another wave of contagion. In addition to 134 of SBF’s companies and subsidiaries that have already filed for bankruptcy, there will be countless other companies that have been completely destroyed by this collapse, which could set the entire crypto industry back several years.

BlockFi (which already went bankrupt in Q2 before being bailed out by FTX) appears to have deposited all of their client funds to FTX, and now doesn’t have any. Despite saying that they were unaffected, the next day they also declared bankruptcy and their internal Slack channels were unceremoniously shut down.

Sequoia Capital have already announced that they have written off their $210 million investment into FTX, and there are sure to be many more companies that are underwater.

It remains to be seen just how far this debacle will go, but many, such as the Bitcoin OG Cobie, speculate that this charade may have set the industry back several years — it will most certainly lead to a prolonged bear market.

The FTX exchange has now been hacked?

In another twist to the tale, it has now emerged that the FTX exchange has now been hacked. This is an ongoing development, and as of now it isn’t exactly certain what has happened here, but it does seem a highly unusual development.

Thus far, it appears that over $300m of crypto has been stolen from the exchange and converted into ETH and DAI, which are more censorship-resistant than stable coin asset like USDT and USDC (which can be proven by their relevant issuers).

There was some speculation about whether or not this was an inside job, given the timing and the difficulty with which it would ordinarily take a hacker to steal the funds of an exchange that surely must have had better security. Any reasonable actor would expect that an exchange like this must have been using multi-sigs, hardware wallets, cold storage, etc.

It has been recently confirmed in the last hour that the hacker was indeed most likely an insider or someone extremely inexperienced. The hacker decided to move some of their funds to Kraken to offload them, and the Chief Security Officer of Kraken, Nick Percocco, has now confirmed that they know the identity of the user — you could not make this up.

Is SBF part of an “elite” paedophile ring?

One of the more bizarre theories to have emerged over the course of recent days have been the links drawn between SBF, his girlfriend Caroline, and other characters that he is closely related and linked with.

His political lobbying has long been problematic for the cryptocurrency industry, with the majority of participants extremely dissatisfied by the fact that their main representative campaigns so relentlessly for more restrictions on their liberties. This has even given fuel to some wild accusations that SBF was planted by the deep state in order to intentionally destabilise the reputation of the industry.

The thread above highlights some of the more bewildering conspiracies that are currently circulating, and although I do find some of the links to be somewhat tenuous, there is no denying that there is some legitimate cause for concern, and further investigation required.

SBF should go to prison for this … but will he?

Misappropriating customer funds to entertain one’s own ridiculous spending habits and degenerate directional gambles on the market is certainly severe enough to be sent to prison, especially given the scale of SBF’s operation and the level to which he almost solely responsible for the chaos.

However, there are some who believe that the 30 year old former billionaire will still manage to escape a prison sentence. Comparisons have been drawn with some of the other founders that have collapsed over the course of 2022, none of whom are in prison. Alex Mashinsky, Do Kwon, Su Zhu, Kyle Davies, and others all remain free, enjoying a life of luxury with some of their ill-acquired gains.

There have even been some comparisons drawn with the MF Global in scandal in 2011, which also involved a figure who was heavily linked with the world of US politics. In that scandal, Jon Corzine (who had been an US Senator for New Jersey from 2001 to 2006 and Governor of New Jersey from 2006 to 2010), had extremely high conviction on trades in the European bond market. He had so much conviction, in fact, that he decided to misappropriate $700m of customer funds in order to finance his plays - which didn’t work. When all was said and done, Corzine was forced to finally pay a penalty of $5m to the CFTC, and served no prison time.

Currently, Crypto Twitter, is in the midst of tracking SBF’s private jet, which has conspicuously decided to make an unannounced trip from the Bahamas to Argentina.

To put this into context, despite the tens of billions of dollars that each of the aforementioned characters have cost the industry through their own stunning degrees of avarice, the main victim of the crypto legal system of 2022 remains to have been the developer of Tornado Cash, who is still languishing in a prison in Amsterdam for writing open source software.

Always self custody - don’t trust, verify

The most insidious part of the FTX downfall was that it was marketed as one of the safest and most regulated exchanges in the world, with many industry leaders recommending it as such. People with experience of the industry, who really ought to have known better about the risk of trusting even the “most legitimate” counter parties, continued to shower FTX and SBF with compliments and retail clients with assurances.

Kevin “Mr Wonderful” O’Leary even declared:

“I am a paid spokesperson to FTX and a shareholder there too. I’m a big advocate for Sam because he has two parents that are compliance lawyers - if there’s ever a place I could be that I’m not going to get in trouble, it’s going to be at FTX.”

Always use a hardware wallet. The entire cryptocurrency industry is predicated on liberating individuals from needing to trust third parties. It is for this reason that decentralisation is important, and why leaving funds on exchanges has always been a bad idea. There are very few exchanges that haven’t suffered hacks and exploits, and there are very few places where one could have kept their Bitcoin throughout its history where it would have been safe - it is important that users learn to take responsibility rather than defer responsibility elsewhere.

The silver lining: proof of reserves

There are some silver linings to this entire debacle, most notably the fact that exchanges have been falling over themselves in the past few days to begin providing proof of reserves. It is worthwhile noting that this is not something that is ordinarily required of financial institutions such as banks, who remain far more opaque than exchanges.

Given that regulators coming into the space will now most likely take an extremely aggressive stance on the state of regulation in the space, this is something that definitely ought to happen.

It has led to some interesting Crypto Twitter banter in so far as it transpired that 20% of Crypto.com’s balance is comprised of SHIB, but it is definitely a step in the right direction.

Nevertheless, centralised exchanges showing their proof of reserves isn’t a panacea, since it doesn’t also show what their liabilities are and how many claims there are to the capital they have in reserves.

The Bitcoin maximalists were right again

Everything about this fiasco, from the meltdown of the FTT token, the subsequent collapse of the price of SOL (since FTX and Alameda were both large investors in Solana), and the loss of billions of dollars thanks to trusting third parties, is something that Bitcoin maximalists have now been warning of for years.

Those making the case that DeFi has performed relatively well during this collapse are making a fair case: a lot of DeFi has performed well. Nevertheless, there have been problems: Solana’s token price isn’t just down, but wrapped assets on their platform are also taking a massive hit since they now aren’t collateralised by anything. BadgerDAO has decided to completely discontinue their ibBTC offering thanks to new concern that FTX’s collapse could affect renBTC, meaning that there are even aspects of DeFi on the Ethereum blockchain that are struggling significantly. If there are admin keys and backends, multi sigs for bridges, or upgradeable contracts, something can’t be truly considered decentralised - there is a scale as to the extent to which different parts of the cryptocurrency ecosystem are decentralised, and even though some are faring relatively well during this collapse doesn’t mean that they will forever.

Since the merge, the Ethereum blockchain has become even more centralised, with a largely-unaccountable group of semi-anonymous software developers at the Ethereum Foundation taking large decisions that affect the rest of the network without an appropriate level of discourse that one would expect from “true” decentralisation. What makes something decentralised isn’t the fact that people can have a vote over the governance of a particular project, but there is no governance. Those claiming that Ethereum is decentralised must caveat this by explaining that Ethereum is relatively decentralised when compared with other Turing complete blockchains. There is certainly no way to argue that four entities controlling over 50% of validators, and almost 100% of blocks now being OFAC-compliant, represents a decentralised system. A blockchain that has a roadmap for future developments, such as the upcoming Shanghai hard fork in 2023 (which will see 14m ETH being unlocked, ready to dump on the market) is not the epitome of decentralisation.

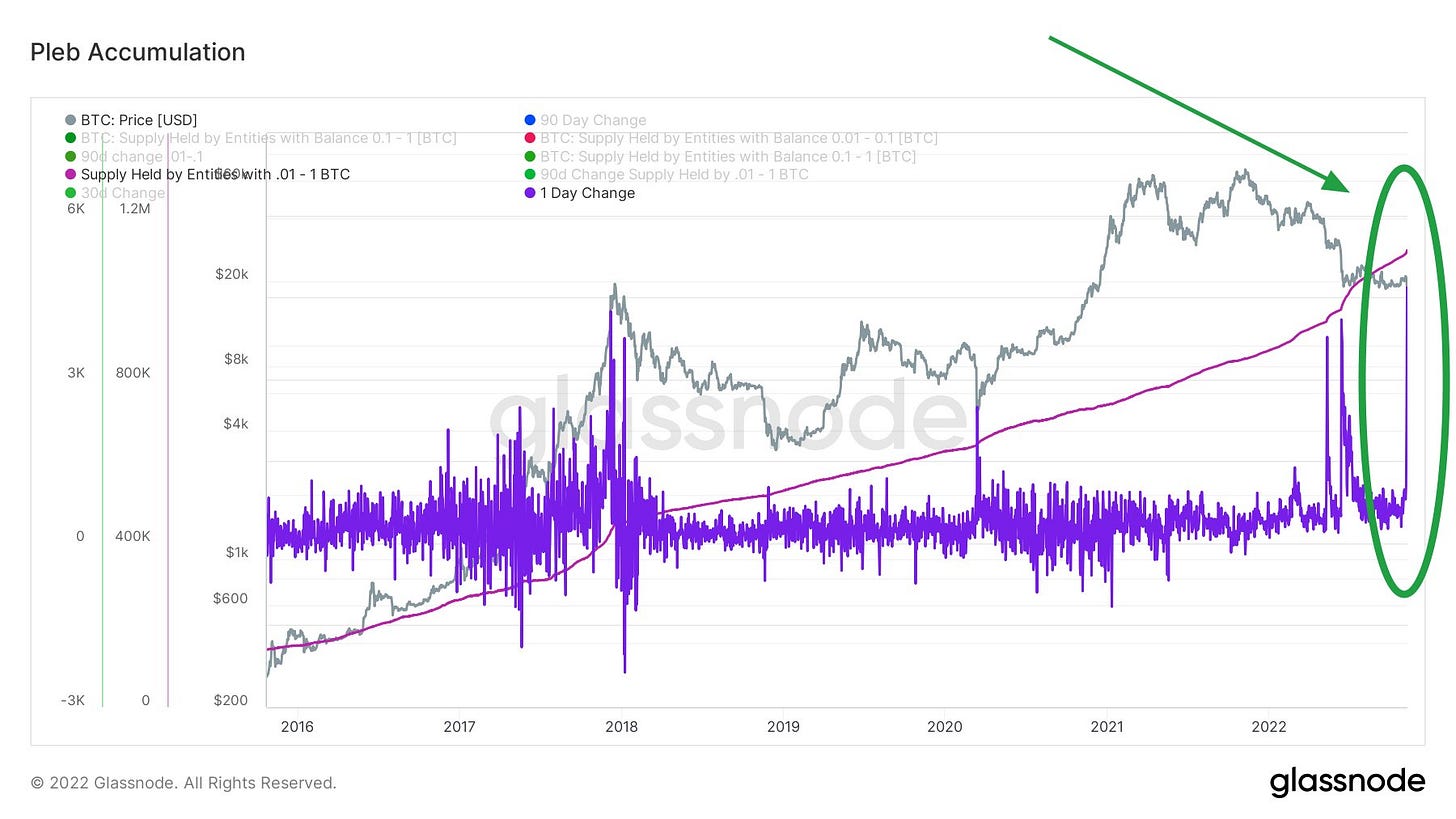

Bitcoiners, and particularly Bitcoin maximalists, understand this phenomenon very well, and despite the volatility in prices over the course of the last week, have remained completely protected from the financial chicanery of irresponsible counter parties. Every day, there are more Bitcoiners and Bitcoin maximalists being minted, as evidenced by this week having some of the largest increase in balances of 0.01-1 BTC.

If you enjoyed this, please share it — I really appreciate it.

Writing this article was tricky because every time I took a 10 minute break there was another implosion. I have no doubt that much of what I have written will be obsolete within 24 hours.

Most importantly, make sure you don’t hold any significant funds on exchanges (regardless of proof of reserves) and acquire a hardware wallet. The whole point of crypto is taking personal responsibility and removing counter parties.

As always, I welcome feedback.

Nice summary. The Alameda nonsense is peak hypocrisy as you well outline. And DeFi has more or less remained steadfast despite the CeFi issues.

I feel though, that CeDeFi is important. It's realistically the way a lot of users need to be onboarded, not to pump bags or grow adoption, but to actually help people step outside the financial system. We need to have people move to self custodial solutions for sure, but we need to recognise that Coinbase, Binance, Kraken will play a crucial role in empowering people to move across.

As a final comment, shoehorning maximalism right at the end is an odd editorial decision (IMO), you've raised some very contentious claims that deserve more justification than a line in a concluding paragraph. Other than that, enjoyed the article.

Excellent advice. A hardware wallet is about as secure as you can get these days.