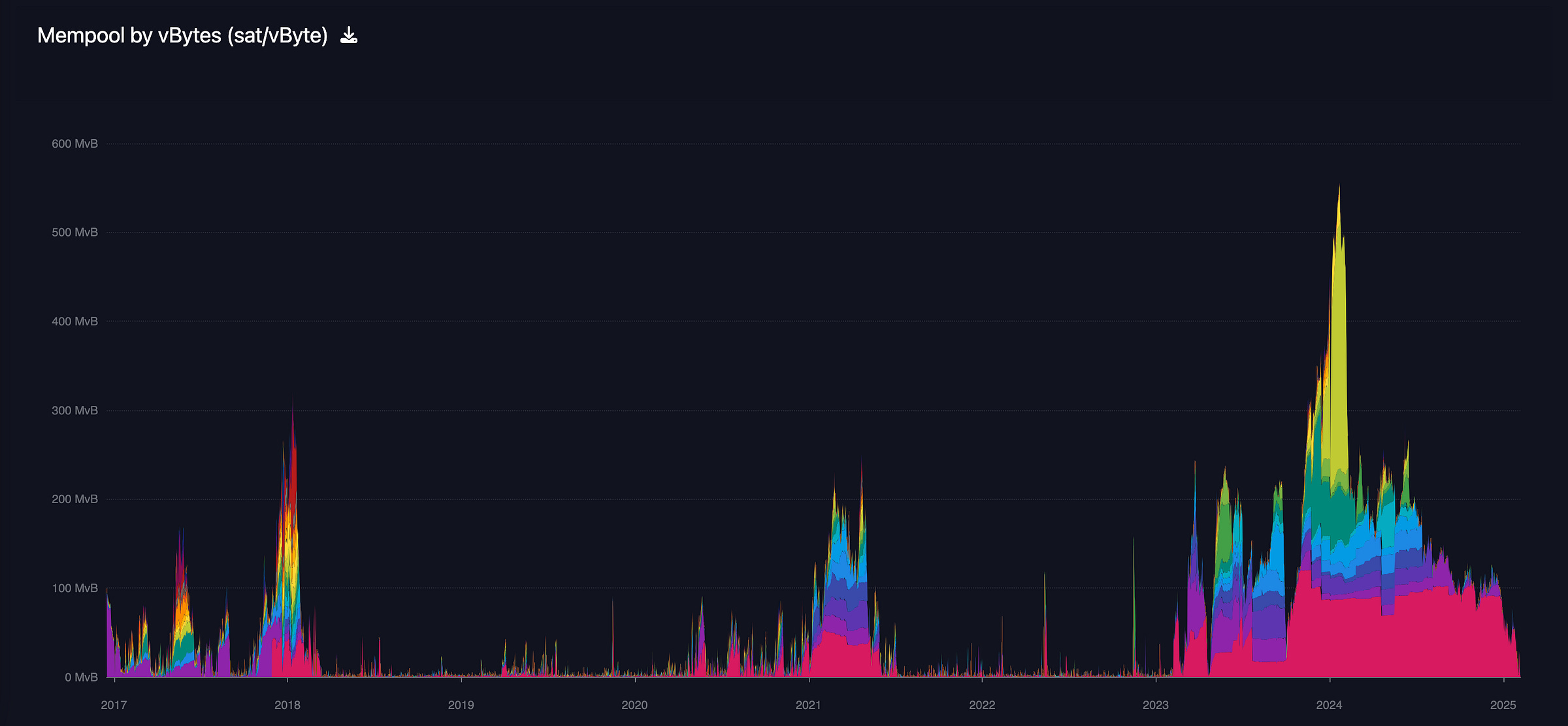

The proliferation of Ordinals and inscriptions in 2023 and 2024 created a huge demand for block space, with fees rising as high as 500 sats/vByte at the peak.

However, the mempool is clear once more, with fees having fallen to just 1 sat/vByte. For some, this has been opportunistic (time to consolidate UTXOs!), and for others, this has invited further consternation about Bitcoin’s long-term security model (perhaps one could even go as far as to credit this for the recent price appreciation of XMR, whose emission schedule doesn’t quite trend to zero in the same way that BTC’s does)

Fees must go up again

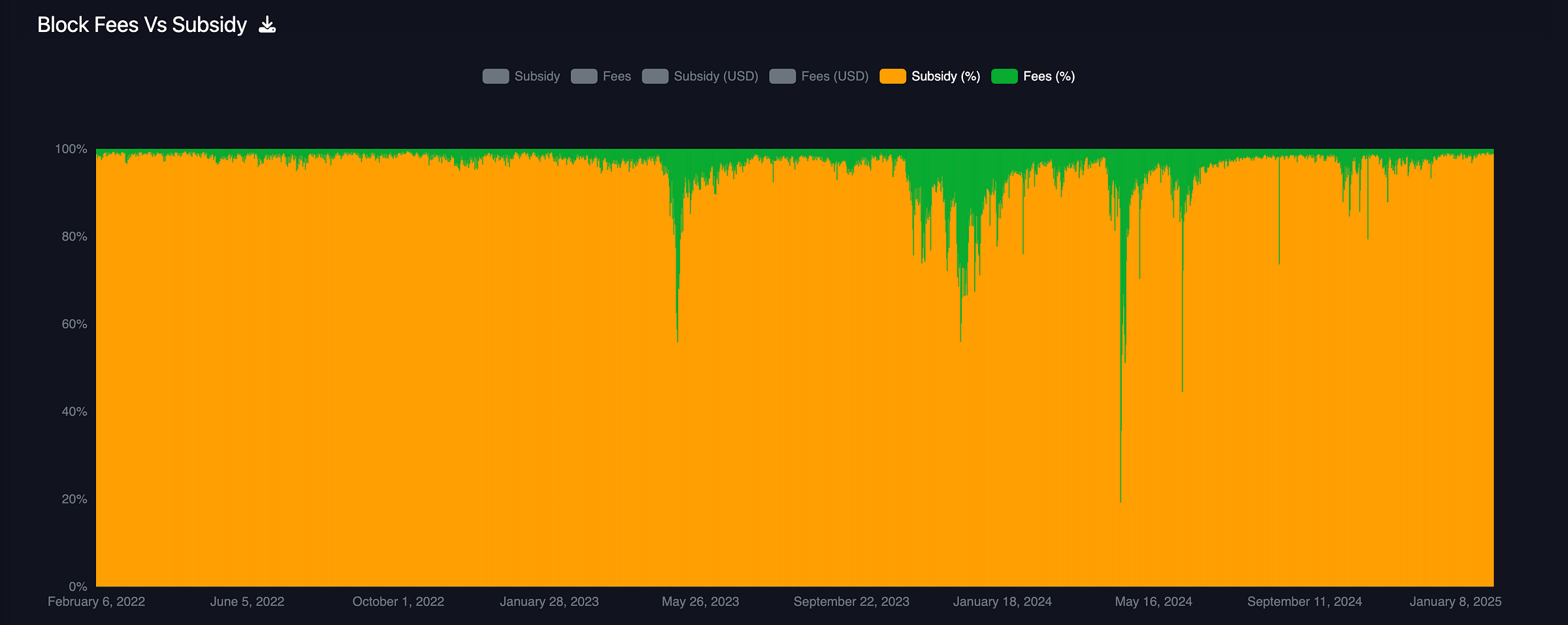

The block subsidy is cut in half with each halvening, meaning that over time the block subsidy ought to become a smaller and smaller part of miner revenue relative to fees, until Bitcoin can eventually function via fees alone. A cursory examination of the chart below shows that fees are becoming a more significant part of miner revenue, albeit in fits and spurts.

A core tenet of being a “small blocker” ought to be the recognition that fees are an inevitable and necessary part of Bitcoin: as the block subsidy dissipates, fees will become the crucial source of revenue for miners. To my mind, this was the largest logical fallacy that the “big blockers” entertained: after all, without the concession that fees must exceed block subsidy in the future, there is no rational way to entertain a hard cap of 21m; in other words, you can’t be advocate for both a 21m hard cap as well as a block size that consistently rises. One megabyte blocks are fine — they always will be. Deviating from 1 MB blocks is fraught with inflationary risk, and it isn’t worth compromising Bitcoin’s security in sake of that.

What to do about this?

Insofar as pragmatic advice is concerned, it seems that now would be a good time to consolidate UTXOs. Those of you that have UTXOs under 1m sats ought to rectify this whilst you have the chance.

Despite being lambasted by a certain segment of the community, I find Jason Lowery’s Soft War thesis to be extremely compelling. There are important reasons as to why fees for UTXOs should rise, and why they inevitably will rise. It may well be true that bitcoin is for everyone, but isn’t true that Bitcoin is for everyone (the distinction between the lower case “b” and the upper case “B” is the distinction between the unit of account and the network itself). Most people won’t use Bitcoin’s layer one: it’s simply not designed for that — if you have UTXOs less than 1m sats than you probably ought to promptly consolidate them, lest you lose a significant amount of your holdings.

The reason for this is that, as the most secure protocol on the planet by far, there is enormous value in storing information on the Bitcoin blockchain (nobody serious really gives a shit about storing information the Ethereum blockchain, or any of the other alt chains). Hence, if one wishes to immortalise a piece of information, whether it be a death certificate, birth certificate, wedding certificate, military information, results of an election, etc., it’s worth using the Bitcoin blockchain for inscriptions. The result of this is that Bitcoin won’t only be used for transactions; as Hal Finney said as early as 2010, there are many use cases other than simply money:

“Bitcoin is a consistent yet global decentralised database. This database is used to record transfers of coins, but it could potentially be used for more. There are many applications for a global consistent database.”

The Twitter user Wicked has done some fascinating research on this, in which he demonstrates that it’s simply impossible for the base layer to be accessible for the vast majority of humanity — they’ll simply never be able to afford it. This isn’t a mistake; it’s by design. Most of humanity doesn’t have any resources whatsoever, and so for them to compete for block space is nonsensical. The aforementioned has spent the last few years encouraging Bitcoiners to consolidate their UTXOs so as not to find themselves lost in the wilderness.

How to deal with fee spikes?

Having seen the charts above, the obvious quandary is that these spikes in fee revenue aren’t evenly distributed. Perhaps they’d become more even in the future, but to expect any such consistency in this regard could be perilous, given that the inevitability of unpredictable market conditions triggers these spikes. Fortunately, this can be addressed:

There are several aspects to this:

Fee smoothing via batching

Adam Back has proposed that a potential solution to this quandary could be to smooth out fees via batching. This would involve combining several transactions together, so as to reduce total fees paid by each individual user. Nevertheless, it would result in a higher fee for each block space occupied — this could smooth out fee revenue and smoothen out the peaks and troughs of fee demand.

Education

Education is crucial for Bitcoin to continue to proliferate — in particular, education is crucial for Bitcoin users to benefit the most from the protocol. This is important insofar as user behaviour is concerned: one would hope to advocate that users of the Bitcoin network consolidate UTXOs when sats/vByte are low. Obviously, this isn’t easy to predict.

Miners to profit at near-zero marginal cost

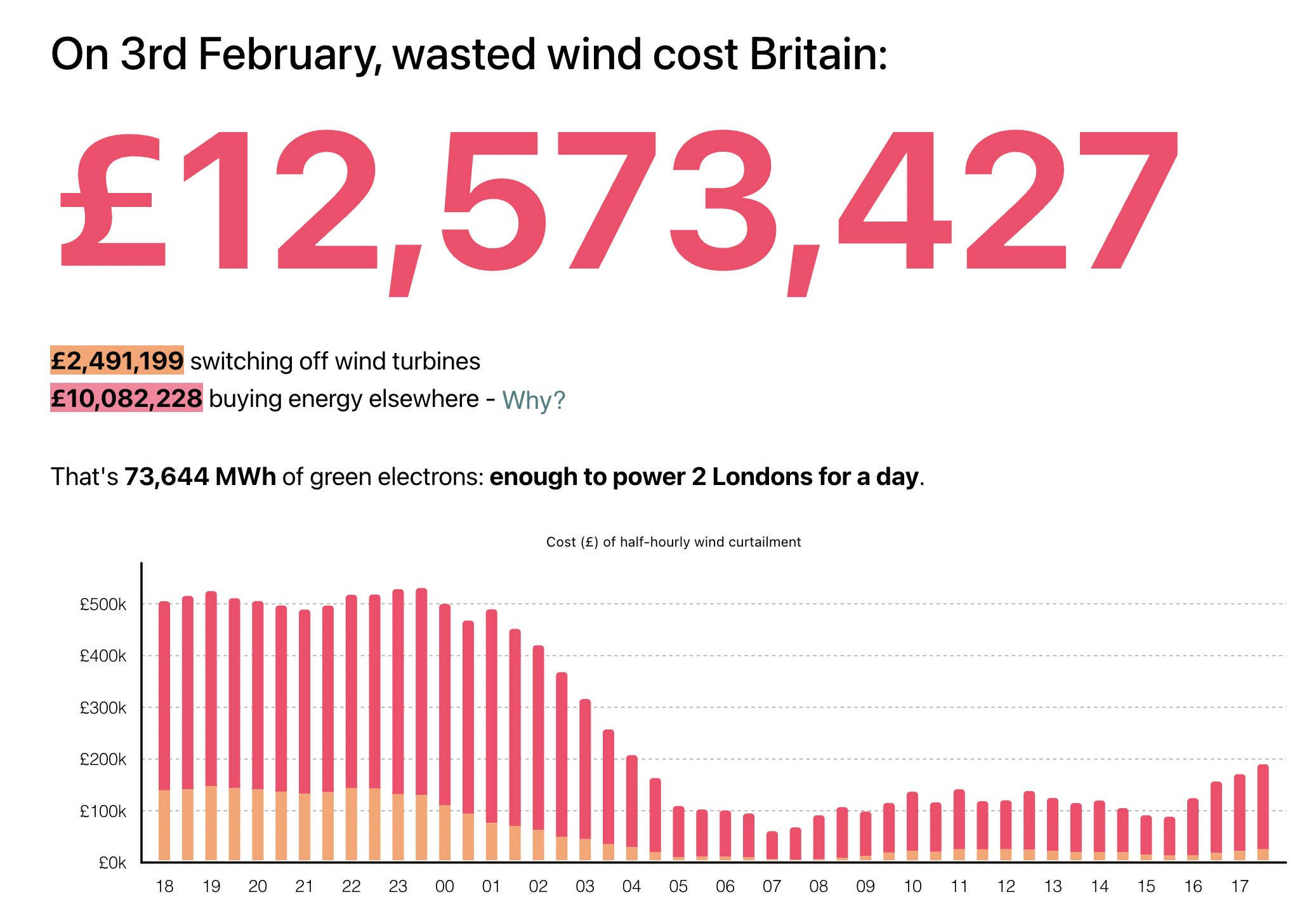

Perhaps the most obvious example of this is the inordinate amount of money that the British government currently wastes with their policy of “becoming the Saudi Arabia of wind energy”. The retarded morons of the Uniparty, like Grant Schapps and Ed Miliband, are not ascribing to logic when they pursue these insane policies; they are following purely ideologically-driven motivations that have no relevance to the real world. In fact, in the latter case, one might argue that Miliband is intentionally making bad decisions because he is compromised by foreign powers.

Right now, one of the most important segments of the energy industry in the UK is capitalising on not wasting surplus energy. This is something that Ed Miliband, a certifiable retard, does not understand. If energy is produced at a marginal cost of zero then it costs nothing to whack on a bitcoin miner and harvest the excess.

The UK currently wastes millions of pounds every day because of the inefficiencies of wind energy. These are inefficiencies that could be easily dealt with if the Civil Service paid enough attention — but they just don’t care. From my conversations with people in The Department for Energy and Net Zero, there is no hope: these people are disgustingly stupid. It revolts me how sanguine these autistic bureaucrats are about the future of the country. They don’t actually give a shit about improving things, they’re just hoping for a promotion or job offer elsewhere1. These people claim to represent Britons, but I’m offended by how stupid some of these people are.

Therefore, we ought not be worried about peaks and troughs in fees (which are difficult to predict), so long as the hash rate continues to rise. We recently came to exceed 800 TH/s, and despite the potential consternation of these market dynamics the Bitcoin network shows no sign of slowing down.

What are the alternatives?

Other blockchains have recently found themselves mired in a litany of other disasters, not least of which Ethereum, which has been losing market share to Solana. Moreover, the Ethereum Foundation has found itself to be in a governance kerfuffle over whether to prioritise scaling and utility over being a store of value asset. Recent upgrades such as ETH 2.0 (moving from PoW to PoS) and the Dencun upgrade would seem to indicate that Ethereum developers are more concerned with utility than storing value (their “ultrasound money” narrative has thus been taking a harsh hit). It ought to be fairly easy to pinpoint when the Dencun “upgrade” happened on the chart below:

I’d write more about XMR, and perhaps I will, but it’s outside the scope of this article. The important thing is that Bitcoin is fine (as always), and although fee revenues may oscillate in the short term, they’re sure to appreciate and more than compensate for the block subsidy in the long term.

However, the real answer is that there is no alternative. As Saifedean Ammous has argued, Bitcoin isn’t something you can simply opt out of:

“Bitcoin won’t be adopted like the iPhone because it’s cool. It will be adopted like gunpowder: if you don’t own it, you will be its victim.”

Further reading, from August 2023:

I also people who are brilliant in the Civil Service, but not in the department mentioned above.