The nationalist zeitgeist of Germany’s summer, Ausländer Raus, strikes me as ironic given the extent to which the aforementioned are exiting the Bitcoin markets. The Ausländer will be the only ones left!

In 2021, the German government seized circa ~25,000 BTC linked to the illegal streaming site Movie2K. The popular platform specialised in pirated films and shows, and the two men in charge of the company decided to launder profits from the site by acquiring BTC and real estate.

Working in collaboration with Chainalysis, Coinbase, Binance and Kraken, German law enforcement was able to track and seize the BTC. At the time, BTC was trading for approximately €30,000, meaning that the entire haul was worth roughly €750,000,000 at the time.

Further seizures over the years have meant that, in total, the German government has seized ~50,000 BTC, which they began to liquidate a few weeks ago. In total, assuming a price of ~$60k, this would be worth ~$3bn (€2.75bn).

The decision to sell the BTC, rather than keep it as part of a national reserve, has been contentious. Several high profile politicians have urged the government not to follow through with the sales. Joana Cotar, in particular, has asked the Finance Minister to rethink the strategy, and invited several high profile German politicians to an event called “Bitcoin Strategies for Nation States”, which will feature notorious orange-pillers such as Samson Mow, who has recently been advising El Salvador and Mexico on formulating pragmatic and coherent Bitcoin policies.

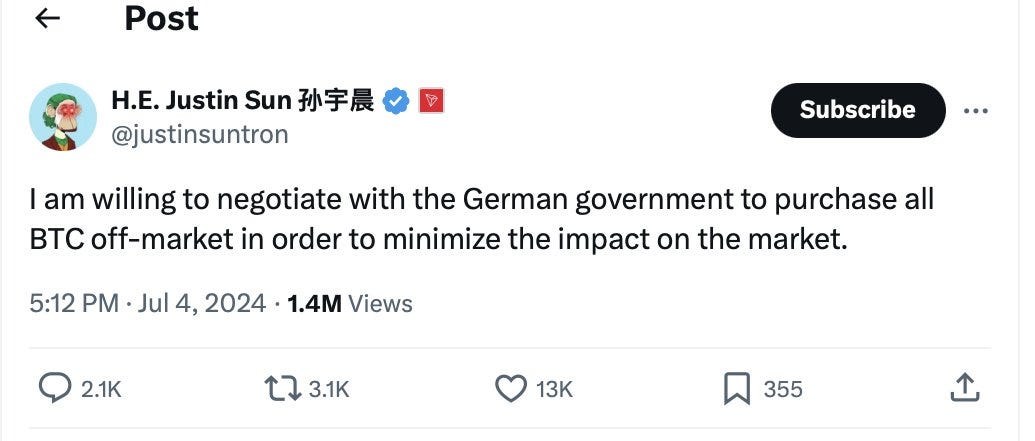

Undoubtedly, such a large amount of selling pressure has had an impact on the markets, which broke out from the bottom of the $60k-$70k range, falling as low as $53.5k. Interestingly, one of the main critiques levied at the German government during this entire debacle hasn’t been the fact that they took the decision to liquidate the asset, but rather the nature of how they are exiting their position. Despite numerous offers for OTC deals from the likes of Justin Sun, the government has instead decided to dump BTC on the market — perhaps the most inefficient way for them (since they’ll be able to buy far fewer euros), and also the most detrimental for the price. This, in addition to the commencement of Mt. Gox repayments, appears to have spooked the markets in the short term, which have fallen almost 30% from the ATHs four months ago. Inkompetent.

However, as always, there are silver linings. As of today, the Germans have now sold all of their 50,000 BTC, and cannot dump any more on the market — much to the schadenfreude of those looking to acquire at a discount.

This will almost certainly turn out to be a strategic blunder, as has been the case for every country that has decided to sell its Bitcoin reserves. The US government forfeited billions when selling BTC confiscated from Silk Road. In 2017, the Bulgarian government confiscated ~214,000 BTC. They has not made any recent public disclosures about the status of these coins, but if they still have them then they would now be worth ~55% of the country’s national debt (which stands at ~$23bn).

Countries that have continued to add to their holdings, like El Salvador (Bukele has stayed true to his promise of acquiring 1 BTC/day), have been reaping the rewards. Not only are their direct Bitcoin acquisitions now in the green, but the excitement around the topic has catalysed an explosion of tourism and foreign investment.

One can only hope that Mow, and others of his ilk, can find the time to talk to British politicians so that they don’t make the same blunder. The UK government currently holds 61,245 BTC, most of which were seized from a Chinese lady (Zhimin Qian) who’d been on the run from Chinese authorities and come to London to buy mansions in Hampstead. Such a large stash means that the UK is now one of the largest holders of Bitcoin, coming just behind the US, which currently has ~213,000 in their treasury.

There is great cause for optimism here (weltschmerz if you’re German), given that the political discourse around Bitcoin has changed significantly in the last few months. Now, Trump is talking about the possibility of using BTC to ameliorate the US’s national debt, and using the asset as a strategic reserve for the country.

Moreover, there are tentative signs that the Westminster Blob is finally starting to pay attention to Bitcoin, with the likes of George Osborne and Ed Balls recently discussing the topic on a podcast. It’s important that such political heavyweights can convey the message in a coherent manner (meet with BPUK!). It surprised me that Bitcoin wasn’t mentioned a single time on the campaign trail in the elections we’ve just had, given that an estimated ~2.5m Britons own at least some BTC, and many of them are single-issue voters (in fact, perhaps Sunak knew pro-BTC policies would be a vote winner, and that’s why he didn’t capitalise on it…). It’s not important what our politicians think, as most of them (and I include this new cohort) don’t stand for anything whatsoever. What matters much more is that their blinkered weltanschauungs are guided by the ire of their constituents. We must not make the same mistake as Germany, whose government hasn’t had a good idea in decades.

BRITAIN ALL IN ON BITCOIN

The above title and subtitle may scare and shock a lot of Britons if it were true, but I’ll make the case here that to do such a thing would not only be a bold manoeuvre but sensible and pragmatic. With the economic, social and political issues that the country faces, it is my contention that we must be ambitious. In 2012, Kwasi Kwarteng co-authored